MercadoLibre, often referred to as the Amazon of Latin America, has once again delivered outstanding performance in the second quarter, solidifying its position as a major player in the region's e-commerce and fintech sectors. The company reported robust revenue growth, significant increases in active users, and substantial expansion in its payment solutions, which collectively fueled a notable rise in its stock value. These results underscore MercadoLibre's successful adaptation to market demands and its strategic investments in technology and infrastructure. In Q2, MercadoLibre's net revenue surged considerably compared to the same period last year. This growth was largely attributed to increased online marketplace transactions, driven by rising consumer adoption of e-commerce in Latin America.

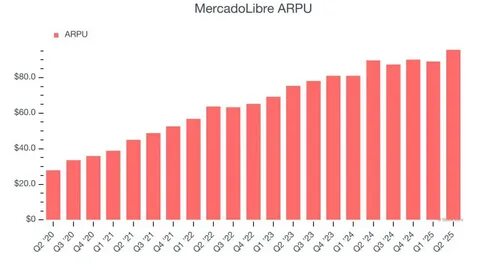

Market dynamics, including improved logistics networks and enhanced user experience, contributed to higher transaction volumes as more customers embraced digital shopping solutions. The company's fintech arm, Mercado Pago, played a pivotal role in the quarter's success. With a growing user base utilizing digital wallets, payment processing, and credit services, Mercado Pago witnessed substantial expansion. The increase in fintech transactions not only boosted revenue but also helped diversify MercadoLibre's business model, reducing dependence on traditional e-commerce sales. Market analysts highlighted several key trends propelling MercadoLibre's growth.

Firstly, the ongoing digital transformation across Latin America has accelerated consumer reliance on online platforms for shopping and financial activities. Secondly, MercadoLibre's continuous enhancement of its technology infrastructure - such as improved mobile applications and AI-driven personalized recommendations - has greatly enhanced customer retention and acquisition. Another critical factor was MercadoLibre's geographic expansion strategy. By entering and strengthening its presence in emerging markets within the region, the company tapped into previously underserved customer bases. This regional growth has been complemented by strategic partnerships and investments in logistics, enabling faster shipping and better inventory management, which in turn elevated the overall customer experience.

Financially, the company reported improved gross merchandise volume (GMV), reflecting the total value of goods sold through its platform. An increase in GMV typically indicates robust consumer spending and marketplace vitality, aligning with the surge in active buyers and sellers using MercadoLibre's services. Investors responded positively to these results, with MercadoLibre's stock price reflecting renewed confidence in the company's growth trajectory. The firm's ability to consistently beat market expectations serves as a testament to its resilient business model and effective management. Looking ahead, MercadoLibre is poised to continue benefiting from Latin America's expanding internet penetration and the region's gradual shift toward digital economies.

The company's ongoing investment in fintech innovations, such as credit offerings and insurance products, aims to further entrench its role as a comprehensive financial ecosystem for millions of users. Additionally, MercadoLibre's commitment to sustainability and community engagement aligns with global investment trends favoring companies with strong environmental, social, and governance (ESG) practices. Such initiatives not only enhance the company's brand image but also resonate with socially conscious consumers and investors. In conclusion, MercadoLibre's strong Q2 performance is a clear indicator of its dynamic growth and market leadership in Latin America's e-commerce and fintech arenas. The combination of expanding user engagement, technological advancements, and strategic regional investments creates a solid foundation for continued success.

As digital adoption deepens across the region, MercadoLibre remains well-positioned to capitalize on emerging opportunities and deliver value to its customers and shareholders alike. .