Collapse of the FTX cryptocurrency exchange in November 2022 has greatly affected many investors, creating confusion and uncertainty regarding the repayment to creditors. As the dust starts to settle after years of legal battles and bankruptcy proceedings, there are now definitive schedules for possible repayments to creditors. One key aspect of this process is the two-tiered distribution of payments, especially for those who missed the initial payout. FTX, through its Bahamian subsidiary FTX Digital Markets, will begin enforcing its reorganization plan. This plan officially came into effect on January 3, 2025.

The creditors eligible for the first round of payments are primarily those whose claims do not exceed $50,000. These creditors will receive 119% of their adjudicated claim value, which amounts to an estimated $1.2 billion in total distributions. This approach shows a comforting effort to focus on smaller claims first, which affect a larger number of individual creditors. However, larger claims, defined as those exceeding $50,000, are in a more complex situation.

The creditors with larger claims will likely not see any distributions until the second quarter of 2025. This can cause significant concern for those who have invested large sums and were counting on earlier repayments. Current summations suggest that a total of around $17 billion will be distributed in stages, with projections for an initial payout of about $7 billion for these larger claimants. To qualify for any distribution, creditors must adhere to certain regulatory requirements. Among these, completing Know Your Customer (KYC) verification, submitting a W-8 BEN tax form, and onboarding with a selected distribution partner, either BitGo or Kraken, are paramount.

Individuals who have not met these requirements by the time of the February 18 payout will risk missing out on that distribution, but may still be eligible for future payouts once they resolve any outstanding issues. Importantly, FTX has taken strides to ensure that customers are informed of their eligibility. Notifications have been sent to customers who will not receive payments in the initial phase, whether due to their claims being under review, exceeding the cutoff limit of $50,000, or for failing to complete the requisite KYC and tax forms. For the creditors set to receive funds via BitGo, the expectation is for full repayment of their adjudicated claim value plus an additional 9% annual interest accrued since the collapse in November 2022. The exact terms for those opting for Kraken, the other distribution partner, remain less clear, highlighting unexpected elements in the repayment schedule and conditions.

The payments are a vital step towards compensating those affected by the FTX crash. Many creditors have been waiting for compensation for over two years, which has understandably led to growing frustration and concern. As repayment plans unfold, FTX could potentially pay out over $16 billion to impacted users if all claims are processed and settled. As legal proceedings against FTX executives concluded by the end of 2024, much attention has shifted to the storied figure of Sam Bankman-Fried (SBF), who resigned as CEO during the crisis and later received a lengthy prison sentence. The complications stemming from the FTX fallout have not only hurt investors but have also caused turbulence across the cryptocurrency market.

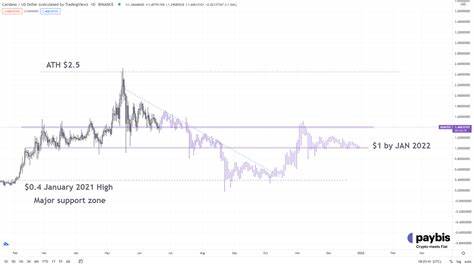

FTX's restructuring plan sought to protect smaller investors, as around 98% of affected users, especially those with claims under $50,000, are expected to receive 119% of their declared amounts. However, opinions remain split on the fairness of these compensation mechanisms, particularly given the surge of Bitcoin and other cryptocurrencies following the FTX crisis. With Bitcoin prices soaring by 370% since the collapse, many creditors argue that basing repayments on bankruptcy-era prices may not reflect current market realities. It's crucial to stay abreast of the changes in the FTX repayment structure, especially for those who have previously felt neglected or disillusioned by ongoing legal and financial uncertainties in the aftermath of the company's fall from grace. Curious investors are encouraged to follow updates on the repayment process closely, as the potential changes could significantly affect personal financial circumstances.

In summary, while the prospect of missing out on the first payout might be disheartening for some creditors, the structure in place hints at a systematic approach to repaying those affected by the FTX collapse. The next phases, particularly the expectations for larger claims in the second quarter of 2025, will be critical in determining how well FTX can restore creditor confidence and move forward in clearing past obligations. As the cryptocurrency space continues to evolve, updates on the reorganization plan and repayment strategy will certainly prove critical for all parties involved.